- FINANCIAL CALCULATORS COMPOUND INTEREST HOW TO

- FINANCIAL CALCULATORS COMPOUND INTEREST FULL

- FINANCIAL CALCULATORS COMPOUND INTEREST PLUS

financial institution to find out how often interest is being compounded.

FINANCIAL CALCULATORS COMPOUND INTEREST HOW TO

All examples are hypothetical and are for illustrative purposes. This calculator demonstrates how to put this savings strategy to work for you. We cannot and do not guarantee their applicability or accuracy in regards to your individual circumstances. Information and interactive calculators are made available to you only as self-help tools for your independent use and are not intended to provide investment or tax advice. Set compounding to "continuous", "daily" or "simple" for daily interest calculations.The American Institute of Certified Public Accountants In this case, the amount of interest will be different for February and March.

There is also " exact day interest." Interest is calculated based on the number of days.

FINANCIAL CALCULATORS COMPOUND INTEREST FULL

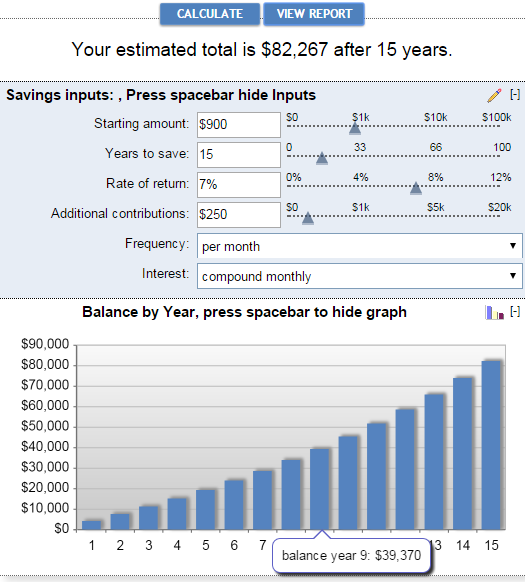

This generally results in 1/2 a month's interest being less than 1/2 of a full month's interest when using monthly compounding. Note if you select a periodic method such as "weekly", "biweekly" etc., and if the dates enter do not equate to a number of full periods, then interest will be calculated for the fractional period by counting the days and calculating simple interest. Given $10,000 principal and an interest rate of 6.75% the interest will be the same for February as it is for March. This is known as " Periodic Interest" In that case, a month's interest is always the same for the same interest rate and same principal balance regardless of the length of the month. Interest may be calculated based on a unit of time, say a month. The Consumer Financial Protection Bureau defines APY in the Truth-in-Savings Act. with your financial institution to find out how often interest is being compounded. It is the rate institutions must quote in the US for interest-bearing accounts. This calculator demonstrates how compounding can affect your savings.

FINANCIAL CALCULATORS COMPOUND INTEREST PLUS

Click "Calc." Interest and future value are calculated (FV is starting amount plus the interest.) Depositors should use the Annual Percentage Yield ( APY) calculation for comparing deposit accounts. If you need to know the interest for 31 days, then enter 31 for the number of days and don't worry about the dates. The above means you can calculate interest for a specific number of days and not worry about what the dates are. If you enter a negative value for the number of days, the start date will be updated. If you enter a positive value for the number of days, the end date will be updated. That is, given two dates, it will calculate the number of days between them, or it will find the date that is "X" days from the first date.Įnter an amount and a nominal annual interest rate.ĭate Math: The number of days between the dates will get calculated when you change either date. You can use this online interest calculator as a:Īs a side benefit to this calculator's date accuracy, you can use it for date math calculations. If you are a debtor, you want to avoid it, particularly if you ever miss a payment or a payment is not enough to cover the interest due. If you are an investor, you want to compound interest. This pattern is called compounding, and it repeats as long as the money stays invested, or the debtor owes on the debt. The previous period's interest earned interest as well.

Then at the end of two years, assuming there have been no withdrawals (or payments) you earn $20.40, not $20. Compound interest means that interest gets paid (or is earned) on previously unpaid interest.įor example, if the interest rate is 2% and you start with $1,000 after the end of a year, you'll earn or owe $20 in interest (using annual compounding).

0 kommentar(er)

0 kommentar(er)